3 Biggest FinTech Trends For 2018

With 2017 coming to an end, we can get a glimpse of what’s yet to come in the next 12 months through the number of investments and product testing.

Blockchain and Distributed Ledger Is Here To Stay

In 2017, a group of 11 international banks developed a trade finance application using R3 technology. In addition, IBM is creating a blockchain-based trade platform called Batavia with six financial institutions on board, to be completed in 2018.

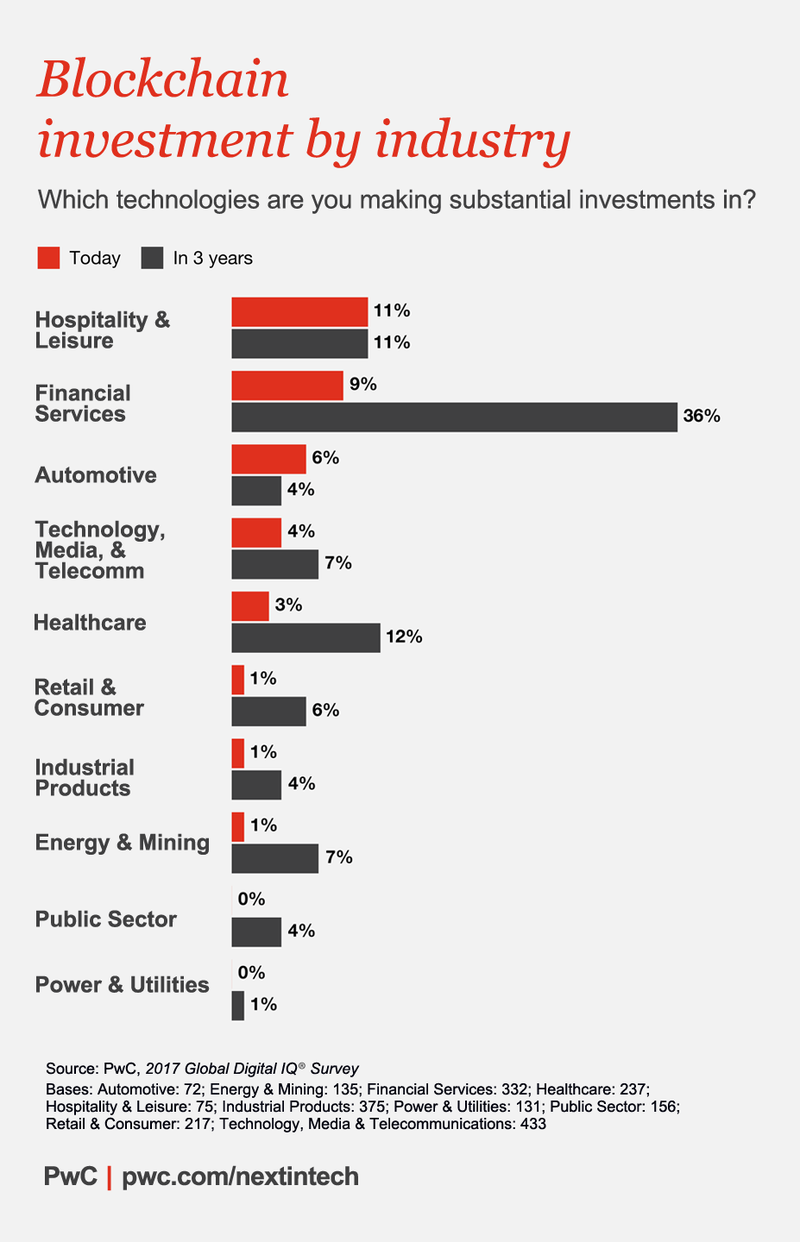

It’s no doubt banks are paying attention to blockchain and distributed ledger technology particularly in trade finance, with 2017 topping the year of production. According to a PwC report, 20 percent of trade finance will incorporate blockchain by 2020. As a result, blockchain could quickly become mainstream within the financial industry in the coming years.

Implementing blockchain technology can alleviate the bottlenecks in trade financing:

- • Blockchain provides full transparency of both parties and will help reduce the cost of Letters Of Credit (LC) transactions since there isn’t a need for a third party verification

- • Dramatically cuts down the time it takes to settle a transaction when an intermediary is not involved. A process that normally takes 10 days can be cut down to four hours

- • Smart contracts offer the possibility of self-executing contracts. Data is monitored and recorded on the smart contract with full transparency and does not require manual processing, nor authentication through intermediaries. As a results, it speeds up the process from beginning to end

- • Internet of Things (IoT) could be used to move physical assets across countries while they are tracked and monitored. However it’s still in the early stages of experimentation in trade finance

A blockchain-based startup that focuses on the foundation of supply chain management is Skuchain. For trade financing, they provide smart contracts that aims to govern all aspect of trade agreements. Skuchain plans to eradicate the use of paper-based Letters Of Credit and are working with banks to shift towards electronic Letters Of Credit that will sit on top of the blockchain.

The goal is to increase transparency into trade visibility and eliminate the time spent on exchanging documents for verification. Since late 2016, Skuchain has been working alongside Commonwealth Bank and Wells Fargo focusing on trade finance for the global cotton market.

The Power of AI

The AI hype has recently peaked with existing implementations across several large enterprises. Natural Language Processing (NLP) is quickly progressing with virtual assistants such as Alexa and Siri understanding complex voice commands. Banks took notice of its potential value and began building interfaces that work with virtual assistants by implementing voice commands for bill pay or balance checks.

It’s safe to say that AI has numerous use cases for financial institutions, but we’re going to focus on one in particular that will potentially kick off for 2018: PFMs powered by AI. Millennials don’t have financial stability with approximately 34% reporting a lack of savings. Financial institutions need to recognize the problem and begin offering their customers advanced tools to better manage their money. This is a case where AI can play a large role with personalization and understand a customer’s spending habits.

AI chatbots are expected to cut $8 billion of business costs by 2022. Many banks are already on the path to a digital transformation with financial management being a top priority. For example, Bank of America created a chatbot called Erica that provides financial guidance to their customers. Similarly, Capital One created an AI driven SMS chatbot named Eno.

Many startups are following the approach of using AI to manage personal finance. One fintech startup in particular is a San Francisco based company called Olivia. They have a B2C approach that provides customers a tool to track, monitor and advise them about their spending habits. For example, you can ask Olivia, the robo advisor, if you can purchase a particular item and not go above your spending limit for the month. A customer can also issue a smart goal setting that helps you budget and save for large purchases, such as a Porsche Cayenne or a vacation to Hawaii.

Cybersecurity is a Major Concern and a Big Opportunity

It goes without saying that cybersecurity is a significant concern faced by businesses and governments worldwide. Highlighted by recent high-profile breaches to Equifax - impacting roughly 143 million people, and Maersk’s projected financial losses reaching $200 million in the wake of the WannaCry ransomware outbreak, cybersecurity has evidently become the focal point in board room meetings. In addition to an increase in breaches, we live at a time where threats are becoming increasingly more sophisticated and fruitful in their efforts. Cybercrime costs are increasing with organizations spending nearly 23 percent more than 2016, an approximate $11.7 million on average. According to ISACA, a non-profit information security advocacy group, the industry will be facing a global shortage of two million cybersecurity professionals by 2019. Beyond this, 54% of cyber professionals anticipating a cyberattack to their organization in the upcoming year based on a McAfee survey of over 1,900 cybersecurity professionals. it’s clear that enterprises aren't adequately equipped to mitigate risk and combat cyber threats.

Though current state of affairs paints a grim picture to the future, we also see a massive growth in investment aimed at addressing these issues. According to CB Insights, cybersecurity investments are predicted to reach $5 billion by the end of 2017. This is a clear indicator that both enterprises and investors are investing in next-generation technologies that can solve these problems. One innovative solution that Plug and Play will be looking into this upcoming year is the concept of “Moving Target Defense.”

Outside-the-Box Data Security Solutions

Cybersecurity methods have not been sustainable in recent years. The new mindset should be reactive to hackers and consider what actions to take once they’re already in the system. However this doesn’t come naturally to many cyber professionals and a cultural change within the workspace is a crucial component to enhance safety. The concept of “Moving Target Defense” (MTD) is an innovative, game-changing opportunity for cybersecurity. Instead of protecting a static infrastructure, which most security teams focus on, moving target defense continuously and dynamically shifts the attack surface which as a result frustrates the attackers. In fact, The Department of Homeland Security were the first to fund the concept of MTD and are supporting startups through commercial partnerships or investment opportunities. Cryptomove, a company specialized in MTD, landed a contract with the Department of Homeland Security in just a few short months after the launch of their product in early 2017. Since launch, Cryptomove signed a commercial agreement with one of the largest banks in Europe. In 2018, cybersecurity will continue to be a top priority for executives and a shift in the mindset for adopting innovative solutions. As a result, the concept of “Moving Target Defense” will take its leap to adaptation.If you work for a corporation that is interested in meeting cutting edge startups tailored to your specific business goals, get in touch here.

If you are a startup with an amazing idea and great technology looking for a fintech accelerator to grow, get investment, and find new clients, get in touch here.